UPDATED: October 12, 2022 - This update clarifies that the recommended formula for the Fire Benefit Charge continues to include a square root in the calculation.

The Regional Fire Authority (RFA) planning committee approved the draft RFA plan for merging two fire agencies of Olympia and Tumwater on Monday, October 10.

The draft plan, including policies on governance, funding, and finance for the proposed RFA, is scheduled to be presented at a Tumwater-Olympia joint city council meeting yesterday in Olympia.

Olympia City Manager Jay Burney said council members from both cities would discuss the recommendations made by the committee.

"It will not be a night to take action because it is like a study session format where both councils can talk together and ask questions, hear responses from one another," Burney said.

Meanwhile, the public hearing on Fire Benefit Charge is tentatively scheduled for Monday, November 14, with details to be announced later.

"The statutes require the RFA planning committee to conduct a public hearing. Then after that, the councils will be able to take final action on the plan," said Karen Reed, one of the consultants hired by Tumwater and Olympia.

FBC formula

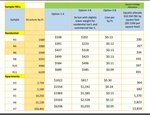

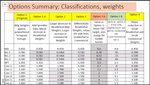

The committee members also approved a Fire Benefit Charge formula during the meeting, computed as (Fire Benefit Charge = Fire Flow x Cost per Gallon Factor x Bldg. Weight Factor x Hazard Reduction Factors x Hazard Increase Factors x Exemption/Discount Factors) and incorporating options, such as:

Reed said the committee had explored six FBC formula options, all but one of which continues to include a calculation that includes a square root. The square root calculation has been criticized as regressive as it places a greater burden on owners of small properties. The committee selected option 3 B (see chart) to present to the city councils.

FBC options

According to Reed, the first FBC formula they presented in the previous meetings includes collecting $13.5 million from each property classification to fund the merging of fire authorities and its operations.

However, the target amount has dropped to $10.5 million following the increased assessed value for both cities by 32%.

Then the consultants started introducing options that reflect the lower target FBC, eliminating the fee for mobile homes, which other RFAs have done, and shifting costs from residential properties to commercial properties.

The consultant presented a modified formula on Monday, which adopts other options and uses slightly lower weight for small residential and commercial sectors.

"The small residential weight reduces from where we started. The largest houses are slightly higher than where we started. Commercial weight is lower. It goes slightly higher in the commercial classes," Reed noted.

Committee member Jim Cooper approved the option presented. "I don't think we can do much more without making it more complicated or throwing it out and starting over with a formula that we think is less regressive. I think we are as close as we will get with this model."

Committee member Michael Althauser concurred with Cooper, saying, "I think we've done what we can to reflect the values we shared and articulated in previous meetings. I think this model approaches those in the best way we can approach it with the tools and other limitations."

RFA Committee chair Leatta Dahlhoff said all voting members are comfortable with and approved the new FBC formula option.

Online calculator

Cooper inquired about the possibility of putting up an online calculator on the website so people can search and check their FBC for their property size. He is hoping that this can be done before holding a public conversation on November 14.

"Every minute we wait after deciding without having that live on our website, [it may] cause more questions and confusions. I know it is a big lift, but if we have not changed the formula, it should not be that difficult either," Cooper commented.

Reed was noncommittal to Cooper's request. "It was a lift every week to get the 20 examples run. We've got 26,000 parcels. Theoretically, you should be able to draft some fabulous macro that could turn your spreadsheets and generate that data."

4 comments on this item Please log in to comment by clicking here

JulesJames

What is the FBC levy assessment for illegal encampments? Or vehicles on I-5? Or folks walking on the sidewalks? Aid calls, vehicle fires and transient mayhem generate the workload, so why are structures being assessed to pay for it?!?!? The FBC is just a work-around voter limitation on government spending.

Wednesday, October 12, 2022 Report this

Southsoundguy

Are we still ignoring the fact that this RFA isn’t going to create any practical efficiencies, it just costs more? No new RFA is the best option.

Wednesday, October 12, 2022 Report this

C K

NO to more taxes. STOP raising taxes. STOP renaming taxes....

Government, at all levels, has become too big, too powerful, too controlling, too intrusive and wasteful.

Thursday, October 13, 2022 Report this

TonyW33

If this hits my ballot it is a firm NO!

Thursday, October 13, 2022 Report this