During the regular city council meeting on Tue., Nov. 23, Olympia City Council members discussed staff plans to increase the little-understood utility tax rate by one percent.

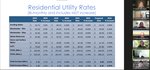

In the discussion, Finance Director Aaron BeMiller shared that the one percent increase would place the city’s utility tax rates at 12.50 percent. These utilities covered by the tax include waste resources, wastewater, storm and surface water, as well drinking water.

The tax is hidden inside amounts billed

BeMiller stated that “This is a tax on the [city's lines of] business, it’s not a tax on the service users.” Like other cities that provide utility services, Olympia is entitled by RCW 35.92.460 to add a tax to its gross utility revenue. Unlike sales taxes, which are shown as a separate line item on customer bills and receipts, Olympia and other cities roll the tax into the amount billed and disclose the tax as required by state law.

State law does not require a separate listing of the tax. Instead, it requires the disclosure to “occur through at least one of the following methods:

(a) On regular billing statements provided electronically or in written form;

(b) On the city or town's web site, if the city or town provides written notice to customers or taxpayers that such information is available on its web site; or

(c) Through a billing insert, mailer, or other written or electronic communication provided to customers or taxpayers on either an annual basis or within thirty days of the effective date of any subsequent tax rate change.

Olympia discloses the tax about halfway down on this webpage.

Tax hike opposed by city committee

The proposal earned an unfavorable response from the city’s own Utility Advisory Committee at the Nov. 16 city council meeting. In that meeting, the advisory committee stated their opposition to the increase, claiming that revenues earned from the utility tax cannot be used as a general government fund.

Utility tax contributes to the general budget

As a response, BeMiller explained that the state law does not provide any restrictions on how revenues earned from the utility tax should be spent. Council member and head of the Finance Committee Jim Cooper also addressed the concerns. “We respect the opinion of the utility advisory committee. We believe that you are doing an absolutely great job of looking after the utility customers,” the council member said.

Cooper, however, explained that the utility tax is not a part of the utility system. “It is actually designed for government to meet its obligations to the community as a general use tax.”

Overall, the finance director claimed that the tax increase is estimated to generate $590,000 in additional revenue to be used in the general fund.

Utility rates hikes also planned

With the increased utility tax added to proposed utility-rate hikes, BeMiller explained that average users whose accounts are billed from $260 to $280 every other month should expect to see a $6.60 to $8.10 increase in their utility bills. That’s about $3.30 to $4.05 per month.

The council has yet to vote on the proposed rate and tax increases; a first reading is scheduled on Tue., Dec. 7, and its second reading on Tue., Dec. 14.

1 comment on this item Please log in to comment by clicking here

Cobbnaustic

Tax, Tax ,Tax, Tax, Tax.

Friday, December 3, 2021 Report this